Our Position: Please continue to support our local grocery stores

Our Position: Please continue to support our local grocery stores Facebook Twitter LinkedIn The following letter was published as a guest opinion

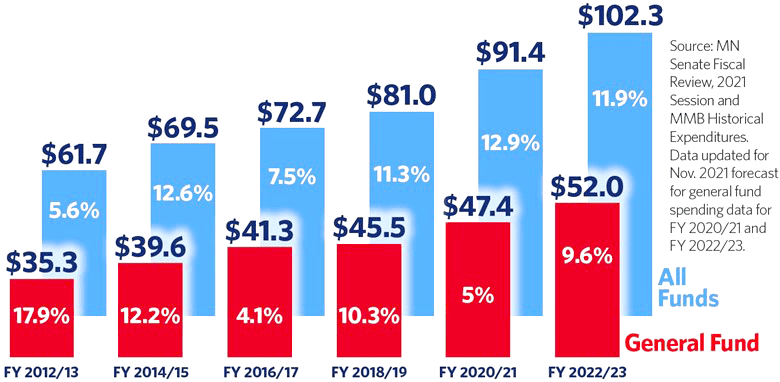

While the state has a huge budget surplus, small businesses are still dealing with the COVID pandemic, workforce challenges, supply chain issues and rising inflation. In order to keep Minnesota competitive, we believe that now is NOT the time to ask for more money or enact more mandates.

Our Position: Please continue to support our local grocery stores Facebook Twitter LinkedIn The following letter was published as a guest opinion

Business After Hours hosted by Camp Ripley Facebook Twitter LinkedIn Tuesday, April 23, 2024 4:30 PM – 6:00 PM Camp Ripley, 15000

Leading the Lakes 2024 Facebook Twitter LinkedIn Wednesday, May 22, 2024 11:30AM-12:30PM Legacy Pavilion at Cragun’s Resort 11000 Cragun’s Drive, Brainerd, MN